utah state solar tax credit

The Utah tax credit for solar panels is 20 of the initial purchase price. The Alternative Energy Development Incentive AEDI is a post-performance non-refundable tax credit for 75 of new state tax revenues including state.

Utah Solar Incentives Creative Energies Solar

It involves filling out and submitting the states TC-40 form with your state tax returns.

. Utah customers qualify for a state tax credit. State solar tax credit in Utah. 1600 is the maximum amount of credit you can get for solar in the state of Utah and all our systems qualify for the maximum credit.

17 Credit for Income Tax Paid to Another State. To claim your federal tax credit you are required to complete IRS Form 5695 when lodging your tax return. Commercial Tax Credits for Infrastructure and.

The credit is for 25 of your total system cost up to a. Welcome to the Utah energy tax credit portal. The Utah residential solar tax credit is also phasing down.

So when youre deciding on whether or not to. The Utah solar tax credit the Renewable Energy Systems Tax Credit covers up to 25 of the purchase and installation costs for residential. The cap dollar amount you can receive begins to phase down as follows.

The process to claim the Utah renewable energy tax credit is actually relatively simple. 12 Credit for Increasing Research Activities in Utah. Utahs solar tax credit makes going solar easy.

We are accepting applications for the tax credit programs listed below. 13 Carryforward of Credit for Machinery and Equipment Used to Conduct Research. For Utah solar shoppers state and local tax credits mean theres never been a better time to start exploring solar offerings.

Everyone in Utah is eligible to take a personal tax credit when installing solar panels. The tax credit for a residential system is 25 of the purchase and installation costs up to a maximum. 350 North State Suite 320 PO Box 145115 Salt Lake City Utah 84114 Telephone.

Utah homeowners have access to the Utah Renewable Energy Systems Tax Credit which is the state solar tax credit. 25 capped at 1200 until 123121. You can receive a maximum of 1000 credit for your purchase.

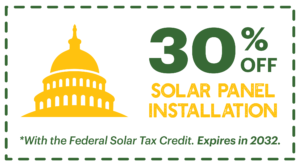

All of our customers qualify for the US. In 2021 the ITC will provide a 26 tax credit for systems installed between 2020 and 2022 and 22 for systems installed in 2023. Qualifying for the Utah Solar Tax Credit.

25 capped at 800. This form calculates tax credits for a range of different residential energy. Under the Amount column write in 1600.

There is no tax credit on solar panels that you. Federal tax credit its technically called the Investment Tax Credit.

2022 Utah Solar Tax Credits Rebates Other Incentives

Utah Energy Tax Credit Rebates Grants For Solar Wind And Geothermal Dasolar Com

Solar Tax Credit What If Your Tax Liability Is Too Small Palmetto

In Utah Thousands Of Homes Feed The Grid Stored Solar Canary Media

Utah Solar Incentives Tax Credits Rebates Guide 2022

A Net Metering Agreement Has Been Reached Park City S Premier Heat Cable Installer On Top Roofing Electric

Utah Solar Tax Credits Blue Raven Solar

Understanding The Utah Solar Tax Credit Ion Solar

Top 7 Best Solar Companies In Utah October 2022

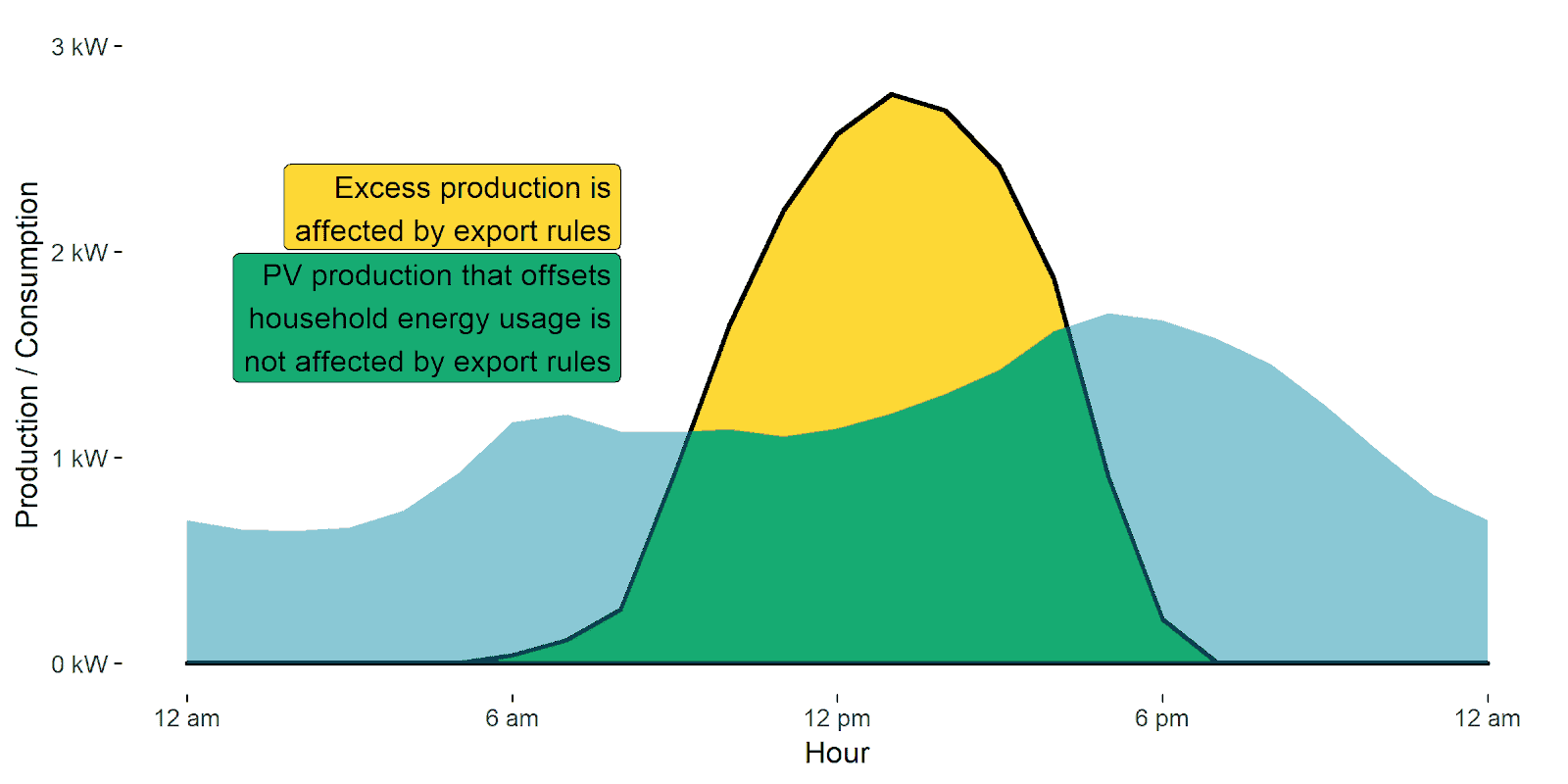

New Solar Export Credits In Utah What The Changes Mean For Installers Aurora Solar

Solar Power In Utah All You Need To Know

The Federal Solar Tax Credit Has Been Extended Through 2032 Ecohouse Solar Llc

The 2018 State Solar Policy Changes You Need To Know

Utah Solar Panel Installations 2022 Pricing Savings Energysage

The Sun Is Setting On The Utah Solar Tax Credit Iws

Itc 2022 How Does Federal Solar Tax Credit Work Marca